- How Much Longer Will We, a People, Accept a Fact That Our Government Ignores Us?

- How Can ADHD Affect Your Life?

- Ja’Mal Green Takes Top Spot on Mayoral Ballot

- Rick and Morty Prefinale Season 6 Review

- TNS, and My Endeavor Into It

- Actress Kirstie Alley Dies during Age 71

- The USPS Is a Hot Mess and Needs a Major Reformation

- Do It Now: There Is No Promise That Tomorrow Is a Reality

- Kanye West Seems to Have Lost His Mind

- Why World AIDS Day Is Important [Video]

How to Build an Investment Portfolio

- Updated: August 29, 2016

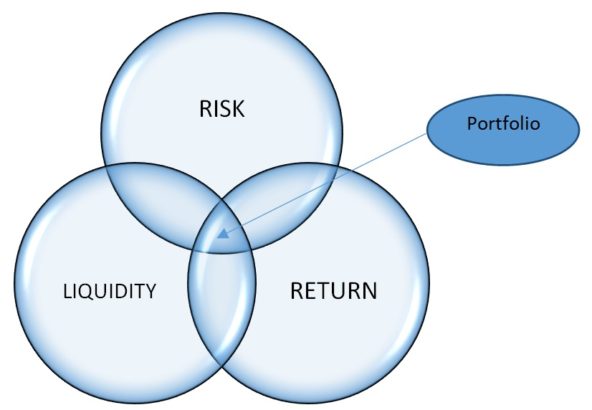

In today’s unsafe financial environment, it has turn some-more critical than ever to build an investment portfolio. Anyone in a financial universe will tell impending clients that diversification and correct formulation are essential to an investor’s success. As for particular investors who are only removing started, they need to know how to structure their item allocation in sequence to grasp their personal investment goals and strategies. The finish outcome should be an investment portfolio that meets an individual’s destiny financial needs and provides a investor with a clarity of security. There are opposite ways to go about building a financial portfolio. The doubt is–what proceed will work best for a individual? In answer to that query, here are some suggestions on how to build an investment portfolio.

When crafting a portfolio, an individual’s financial resources and investment goals contingency be determined. Factors to cruise embody a volume of a investor’s prepared capital, age, life expectancy, health concerns, how many time for investments to grow and/or mature, as good as their destiny collateral needs. Obviously, a young, singular college graduate, who only cumulative their initial remunerative job, will expected need a opposite investment plan than that of a middle-aged, married particular who is awaiting their initial child and a costs compared with it (e.g. child care, education, life insurance, health care, etc.).

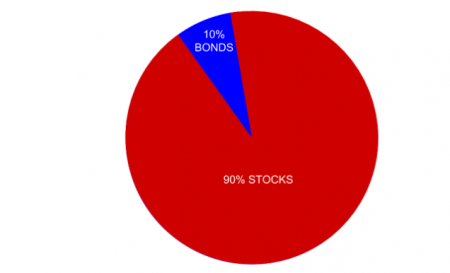

Another critical aspect to discern is either someone should have a regressive or assertive portfolio. This depends mostly on a particular investor, their accessible capital, and risk tolerance. In many cases, a aloft an investor’s risk tolerance, a some-more assertive their portfolio. Meaning, if someone is an financier who is peaceful to take some-more chances, their aloft risks will expected produce larger rewards. This form of financier will customarily opt for some-more equities and fewer holds and/or other fixed-income securities. On a other hand, if someone has a low-risk tolerance, their portfolio will be some-more conservative. This form of financier will concentration on bonds, mutual funds, and other fixed-income holds while avoiding high-risk equities. The finish idea of a regressive portfolio is to strengthen a value and yield some long-term collateral expansion potential. Meanwhile, a idea of an assertive portfolio is directed during appropriation some-more income and collateral expansion around aloft risk investment sources.

Potential investors contingency also be responsive of a fact that building a portfolio takes time and patience. It will not occur overnight, and in a same vain, clients who are starting out should not obsess over a day-to-day fluctuations in a market. They need to know that markets and futures can be utterly volatile. Markets change from day-to-day and even month-to-month. However, these fluctuations will stabilise over longer durations of time. It is critical to settle an investor’s portfolio and concede it to mature. If changes and/or adjustments are needed, it will turn apparent over time.

The one consistent investors contingency belong to is a need for a well-diversified portfolio. This is an investor’s best possibility for long-term, arguable item growth. Moreover, diversification protects an individual’s portfolio from a risks compared with pointy declines and variable changes in a economy.

As investors learn how to build an investment portfolio, they need to know how to structure their item allocation in sequence to grasp their personal investment goals and strategies. In doing so, there are several factors that contingency be considered. Some of these factors embody a client’s glass resources or prepared capital, their marital and/or family status, health considerations, and the amount of time an particular has to grow their investments. Whatever proceed an particular uses to grow their portfolio, a finish outcome should underline a portfolio that is well-diversified, meets an individual’s destiny financial needs, and provides a financier with a clarity of security. At a finish of a day, investment strategies will change depending on a person’s financial and personal circumstances. This is an aspect of building a financial portfolio that many impending investors competence not cruise though should be wakeful of before to creation their initial investment.

Written and Edited by Leigh Haugh

Sources:

Forbes–How to Build an Investment Portfolio: Eight Essentials

Money–5 Simple Steps to a Perfect Portfolio

Investopedia–4 Steps to Building a Profitable Portfolio

Merrill Edge–3 Simple Steps to Building a Balanced Portfolio

All Article Images Courtesy of WikiMedia Commons – Creative Commons License

How to Build an Investment Portfolio combined by Leigh Haugh on Aug 28, 2016

View all posts by Leigh Haugh →